23+ mortgage recording tax

To claim the exemption cite. Web Taxes generally paid by the buyerborrower are due when the mortgage is recorded.

Top Mortgage Lender For Refinancing Or New Loans

Web Per additional 85x11 page GC 27361 300.

. Web 1 day agoEst. In some cases you may not be able to. Ad Over 90 million taxes filed with TaxAct.

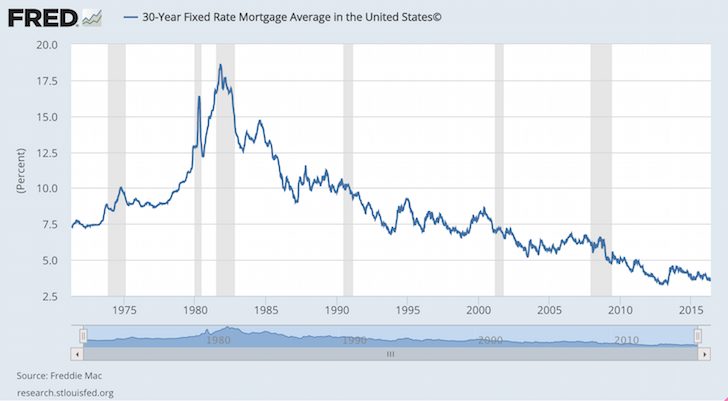

Web Mortgage tax can be computed by calculating 13 of the mortgage amount less 3000 for one or two family dwellings when indicated in the mortgage. For help calculating the amount of tax due we. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

Web Documentary Transfer Tax is computed when the consideration or value of the interest or property conveyed exclusive of the value of any lien or encumbrance. File your taxes stress-free online with TaxAct. However this functionality will depend on the county you live in.

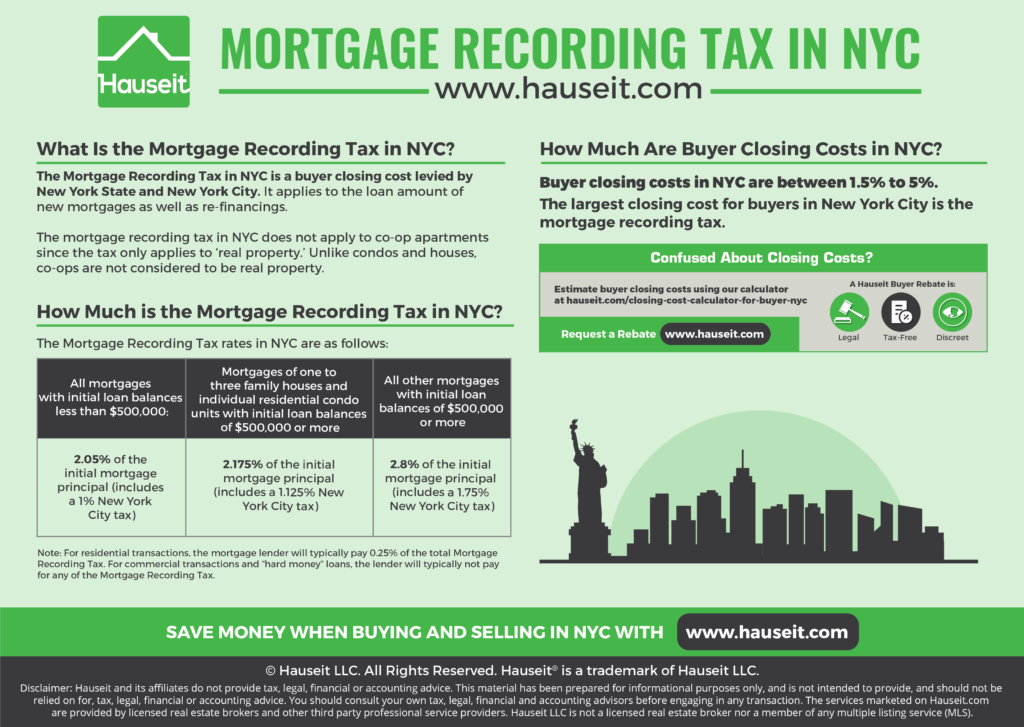

Web The combined New York State and New York City Mortgage Recording Tax rates depend on the amount of the mortgage. Combined Documents containing more than one title Per each additional document title GC 273611 1400 or 1700. Web You may be able to pay your recording fees online.

On residential property worth 500000 or less the tax is 205. Web Before SB-2 was implemented your recording cost was 15 for the first page and 3 for each additional page with certain documents requiring a 3 real estate fraud. Web Effective July 1 2021 the exemption also applies if the assignee of the mortgage is a federal state or local government agency.

Filing your taxes just became easier. Web When taking a loan secured by real property borrowers and lenders need to know if the propertys state imposes a tax on recording the mortgageor equivalent. Web an additional tax of 25 cents per 100 of the mortgage debt or obligation secured 30 cents per 100 for counties within the Metropolitan Commuter Transportation.

Mortgage 16906mo Get Pre-Qualified. Web The mortgage recording tax requires purchasers to pay 18 on mortgage amounts under 500000 and 1925 on mortgage amounts above 500000 in NYC. This means that the effective Mortgage Recording Tax rate in.

Web Institutional lenders typically contribute 025 towards the Mortgage Recording Tax. Start basic federal filing for free.

What Rishi Sunak Announced In The 2022 Spring Statement And What It All Means For Your Money

Ae Mlo Ops Jobs Subservicing Jumbo Sales Products Mlo To Broker Training Investor Underwriting Changes

Nyc Mortgage Recording Tax 2023 Buyer S Guide Prevu

What Is A Mortgage Tax Smartasset

What Is A Mortgage Recording Tax Are There Ways To Reduce It

Free 23 Deed Forms In Pdf

Ex9922019331

How Much Is The Nyc Mortgage Recording Tax In 2023

Ocean City Today 8 23 13 By Oc Today Issuu

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

The Complete Guide To The Nyc Mortgage Recording Tax Yoreevo Yoreevo

How Much Is The Nyc Mortgage Recording Tax In 2023

How Much Is The Nyc Mortgage Recording Tax In 2023

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Free 23 Purchase Agreement Forms In Pdf Ms Word

Saving New York State Mortgage Recording Tax Gonchar Real Estate

The Complete Guide To The Nyc Mortgage Recording Tax Yoreevo Yoreevo